CryptoBars: An Approach to Stable Wartime Currency

Note: This whitepaper is still in the editing process, including missing citations, and may undergo revisions.

Overview

There has been an increasing use of centralized and computerized finance as a mechanism of authoritarian control:

- within a nation, such as the case of Canadian PM Justin Trudeau declaring martial law and seizing assets of political dissidents without parliamentary or judicial approval; and,

- between nations, such as the case of NATO and EU interests banning Russia from SWIFT as a tool of international coercion.

At the center of both are powerful private-public partnerships, such as the World Economic Forum, which some believe to have illegitimate outside influence, such as when martial law was declared in Canada at the behest of US and corporate interests. Indeed, this act of banana-republic finance in Canada has shaken faith in Western institutions as resiliant. This weakness is detrimental to Western interests on the global stage.

In parallel to this, Russia has experienced financial isolation as sanctions for its peacekeeping against Western trained neo-Nazi militias, which for the past 8 years have been engaged in attacks on ethnic Russians in separatist regions of Ukraine. These militias are of such a grevious nature that they earned a rare prohibition on military aid from the US congress – yet remain an official part of the Ukrainian military in Mariupol. That the SWIFT system has become co-opted as a tool of support for neo-Nazi kill squads and to suppress international humanitarian missions in eastern Europe is a dangerous precident.

In both cases, the insular nature of (eg) the World Economic Forum has led to it abusing a trusted instution as a tool of personal enrichment and power, and more broadly, imperialism. In both cases, the immediate consequences were devastating and the long-term consequences remain unseen.

It is in this context that we propose a field manual for creating physical notes representing digital/cryptocurrencies.

Tenets

These are the tenets that will guide our design and evaluation:

- society requires a trustable medium of exchange to facility easy commerce;

- people cannot have faith in instruments they don’t understand;

- society is best understood as a network.

Problem

Special interest groups like the World Economic Forum have co-opted tools of international co-operation into tools of coercion, shattering confidence in both international (eg, SWIFT) and national (eg, Canadian and Chinese) banking systems.

Solution

Trust can be restored in a new banking system by starting with the re-creation of bearer instruments derived from cryptocurrency and replacing the failed political structures, entirely.

Background

Canada declared a numer of emergency measures during the COVID-19 pandemic, including mandates for certain industries to receive vaccinations. One of these industries was logistics, such as truckers – on whom Canadians are deeply dependent due to geography.

After pushback from busines interests within the industry due to possible shortages if the mandates were enforced, the general mandate was withdrawn. However, the Trudeau government insisted that mandates be enforced on truckers crossing borders. This was viewed as retaliatory, capricious, and an effort to “slice off” a segment of truckers at a time. The trucker convoy formed in response, in an act of solidarity within the logistics industry: domestic and international; vaccinated and unvaccinated; etc.

This protest initially converged on Ottowa, where they encamped next to the parliament. Initially, horns were blown around the clock – but after four days, they were restricted to daytime hours to minimize impact on the residents. Additionally, the convoy left one lane open on key roads to allow emergency vehicles to still reach the area. Upon their arrival, Justin Trudeau fled and refused to meet with the protesters. During his leave, additional protests spawned and blocked various border crossings.

Justin Trudeau received calls from US and business leaders about the situation, including demands to resolve it expediently. The truckers blocking borders dispersed after court orders were sought and regular police powers were used by the impacted cities and provinces. However, the trucker protest at parliament was largely upheld in Canadian courts (only prohibiting excessive horn blowing) and persisted after the border crossings were cleared. This personally embarassed Justin Trudeau, who continued to refuse to engage with protesters peacefully seeking rights and freedoms.

Justing Trudeau then delcared martial law, without ever having met with the truckers and with Canadian courts largely finding their protest to be legal. This authoritarian crackdown against the protesters was brutal and swift: after suspending Canadian parliament to prevent debate on his wartime powers, Justin Trudeau sent in militarized police to beat the protesters into submission – often “arresting” them so they could “legally” beat protesters, only to release the protesters at the edge of town without charges. No illegal activity had actually taken place.

We call attention to two particular incidents:

- the brutal beating of a Canadian veteran; and,

- the trampling of a disable First Nations woman with a police horse.

Parallel to this, Justin Trudeau used his declaration of martial law to seize bank accounts of protesters and donors to the protest (including some in the $40-250 range), without any judicial oversight. This led to an immediate run on Canadian banks and capital flight from the Canadian banking system.

Having brutally crushed a peaceful protest for democratic rights, Justin Trudeau withdrew his emergency declaration prior to its approval by the Canadian parliament. This has led to great legal uncertainty. At this time, some protesters remain jailed and accounts remain frozen under the martial law orders.

Analysis

Due to being working class protests seeking rights and freedoms in Canadian society, the trucker protests enjoyed broad support across society. Thinkers across the political spectrum, from Jordan Peterson to Russell Brand, articulated the reasons to support the trucker protest with powerful messages. We would encourage people unfamiliar to listen to our selection: Jordan Peterson] (2.5M views) Russell Brand (1.1M views)

Further, a number of regular people took to the streets in order to livestream the protest. Contrary to the “Black Lives Matter” protests where journalists were routinely attacked by black-clad militants trying to hide their destruction, violence, and arson, these working class protests welcomed cameras and encouraged posting the videos online. Safety at the trucker protest was partially mainted by a volunteer Sikh patrol. Example of streamers who showed the peaceful, carnival nature of the “Trucker Convoy” include Viva Frei and ZOT.

As part of the authoritarian measures taken to suppress this working class protest, companies such as Google/YouTube have censored footage of the protests – both showing the peaceful nature of it before and the violence of Trudeau’s martial acts. The radicalization of channels such as mistersunshinebaby has been stunning, from a vanlife fitness influencer to a political dissident in a matter of weeks.

The combination of three factors has deeply shaken faith in the Canadian government and raised questions of its status as a banana-republic dictatorship:

- Justin Trudeau seized the assets of political dissidents via an unratified declaration of martial law;

- Justin Trudeau responded with physical violence to this peaceful protest while supporting other “regime-approved” protests; and,

- Justin Trudeau undertook these acts apparently at the request of foreign special interests, such as the World Economic Forum and the United States.

In other countries with this fact pattern, our analysis would consider it a(n attempted) coup against the constitutional republic.

This was apparently also the perception of the Canadian public and foreign investors: there were widespread reports of bank runs and capital flight, due to Trudeau’s declaration of martial law. Many speculate that this immediate financial collapse in the wake of his crackdown led to the collapse of the nascent dictatorship: Trudeau recinded his declaration prior to the vote to ratify it, as the Canadian parliament became aware of the economic damage.

However, the damage is apparently done: we believe that it will take substantial reforms to re-establish confidence in Canadian institutions, now that trust has been used as a tool of coercion.

Parallel to this, the actions taken by EU/NATO interests in exiling Russia from the SWIFT system again highlight how the same cabal use finance as a tool of coercion. We believe that this action by the Western aligned banking interests will ultimately prove counter-productive in creating the need for independent finance. With Russia facing the collapse of its currency, it needs a method to stabilize the value of its currency while preventing capital flight.

In both cases, we assess that there’s opportunity for new distributed finance technologies to emerge.

Use Case

Here we’ll explore the usecase driving our technical strategy.

Local Currency

There are a number of local currencies that many readers know: in game tokens, tickets at a carnival, gift cards, etc. In each case, there’s a “local” context in which the tokens work as a currency and some underlying currency that they’re valued against. These local currencies are always redeemable for the underlying currency – but they vary in the mechanism for how, with some administrator who controls redemption of the funds. Eg, in the case of games, the Steam platform is a popular token authority.

There are also less common ones – for example, there are often market-local tokens used in farmers markets to ease exchange between customers with credit cards (buy tokens from operator in bulk) and merchants who receive money (exchange tokens with market operator). Similarly, pachinko balls form a local currency between the parlor and prize store. These examples highlight how tokens can be used for two purposes besides easing transactions: minimizing fees on small transactions and evading legal requirements.

It is this combination which makes local currencies derived from cryptocurrency ideal for restabilizing a financial system.

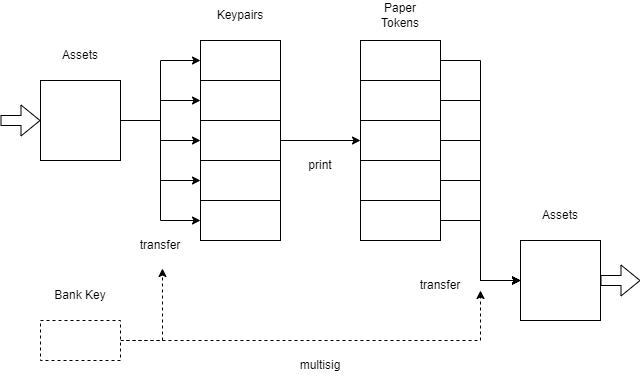

Cycle Schematic

This cycle can be reduced to a schematic diagram – which shows how the backing cryptocurrency is minted into “cryptobars”, which can be exchanged as a local currency, before being “melted” back into the underlying cryptocurrency (with optional controls on the process).

Design

There’s three considerations in this conception:

- how to structure the token itself as currency;

- how to structure the cryptocurrency transaction; and,

- how to structure any signing authority.

We’ll address each aspect in turn.

Design of Paper Tokens

There have been a number of whitepapers written on designing secure paper instruments and we defer to them on the topic of, eg, authentication, tamper-evidencing, and archival-grade features. We focus only on those features which need to be implemented in order to have a paper token. (See appendix for basic example.)

For our tokens, we believe that there are three key things:

- Identification markings, ie what the token represents. A $5-bill represents “$5”.

- The public key and transaction minting visible on the note.

- The private key in a sealed form.

Many tokens will contain additional information, such as the contact details of the minter or date of minting. Additionally, many tokens will include the key information twice: once as a QR code and once in a human-readable format.

Design of Cryptocurrency Transaction

Here we start with the basic premise without any authorizing agent on the melting of the cryptobar. For this case, the transaction is simple:

- Generate a public and private key pair for each token.

- Fund that key with the inteded amount.

- Print the token, with appropriate markings, transaction, and keys.

This can be done as a standard transaction on any cryptocurrency supporting direct transfer to keys/addresses. This includes virtually all cryptotokens.

Design of Signing Authorities

Here we want to consider the case that redemption is controlled, such as the farmer’s market example. We can extend the default transaction to have this structure in its script:

wallet_key AND (auth_key1 OR auth_key2 OR ...)

In this strategy, we require that an authority provide their key in connection with yours to authenticate your transaction, or “melting” the cryptobar. There are many strategies an authority might use, but using auth_keyN = signer_N(wallet_pub_key) is our suggestion. This allows for a trusted device to be loaded with the signer_N key and then scan paper tokens into transactions, for example an ATM that required ID prior to redemption as digital currency.

We believe this can support a robust local currency while alleviating concerns about capital flight or theft from merchants at a market.

Considerations

This section will explore the different considerations and tradeoffs to deploying cryptobars.

The Right Underlying Asset

There are three types of underlying asset that we’ll cover in this whitepaper:

- stablecoins and central bank digital currencies;

- cryptocurrencies; and,

- tokens which represent a good or service.

Both stablecoins (eg, USDT) and central bank digital currencies are ways to represent traditional currency within the cryptocurrency framework. As such, their values are often the most stable choice because the underlying currency is more mature. However, because of their ties to the traditional banking system, a central bank digital currency may be unfit for use within cryptobars. This is a situation dependent consideration: CBDCs would be ill-suited for usage in protests or wartorn regions, but a smart choice for a farmer’s market, carnival, theme park, or casino.

Similarly, cryptocurrencies such as BitCoin, Ethereum, or Doge coin would be strong contenders for cryptobars. While they have problems with price stability, that only becomes impactful when they are redeemed for the underlying asset. Further, each of these has a sufficiently large market to support their value and a sufficiently rich technology to support extended features, such as multisig authorities. Transaction fees on some cryptocurrencies may limit their utility in minting small-denomination cryptobars.

Tokens are another option, where the value of a cryptobar is determined by the goods and/or services for which it can be directly redeemed. These are particularly useful in environments where barter is expected, as you can represent the goods to be exchanged via tokens in paper form for easy exchange during market times – and then claim the goods later, eg when a truck is available. These tokens may provide a secondary market when the underlying good is valuable to many in the community, eg food and water tokens in wartorn areas.

Do You Want an Authority? – Who?

Authorities serve two roles within a currency:

- a check on fraud and theft; and,

- a source of trust in the currency.

These roles can conflict when authorities use their powers against fraud and theft in ways that undermine trust in the currency. However, there are many cases where the benefits of a signing authority outweight the risks:

- farmers markets

- audited aid during emergencies

- unseizable funds during conflict

We suggest that small, local or regional authorities often strike the best balance between the conflicting needs, but that the underlying asset be unregulated when possible. Further, the usage of distributed and overlapping authorities creates a “financial mesh”, where malicious agents can be routed around. While this is antithetical to many authoritarian systems of finance, we strongly encourge the open and federated approach.

Aren’t You Asking for Fraud?

Yes.

All financial instruments are asking for fraud, as people will lie and cheat to obtain benefits. But fraud is ultimatley about that benefit, and when the cost to produce fake cryptobars is “too cumbersome” versus other frauds that the malicious actor could commit, the actual occurence of fraud tends to hover around some reasonably small level.

We believe that there’s a number of approaches that can help with fraud:

- keep the usage of any particular cryptobar in circulation short;

- keep low denomination to each individual cryptobar, increasing the number needed faked for significant benefit;

- keep each cryptobar unique, both with slightly permuted art and with physical processes, such as ink spots.

The combination of these features creates an environment where it’s easy for someone to check the cryptobar against manufacturing records, but hard to replicate certain features at scale.

Conclusion

We hope that you’ve enjoyed this introduction to cryptobars as a mechanism to create local currencies, potentially with an authority on asset extraction.

While the problems motivating this manual are dire, we believe that empowering people to get on with their lives and enjoy them to the fullest extent is an overwhelming good – and we propose tools to help them manage in their communities as best they may, among the various dictatorships of this world.

Live your best life!

Future Work

ZMGS Abstract is working on a further whitepaper introducing connections to NFTs/deeds and showing how paper instruments for digital deeds can be interlaced with the tools discussed here.

Appendix: Proof of Concept – Truck Ticket

We introduce a proof of concept cryptobar, the “Truck Ticket” which might have been used to provide commerce within the Canadian trucker protests for democratic rights – even as a nascent dictator declared martial law and began seizing bank accounts of supporters.

Scenario

We fictionalize the Trucker Convoy protest in Canada to imagine how cryptobars may have features in supporting the protest.

Following the declaration of martial law and seizure of bank accounts, lawyers associated with the Trucker Convoy gathered cryptocurrency assets to their firms and then issued cryptobars of those assets – using their firm as the authority governing withdrawl. This issuing of cryptobars at the protest allowed for supporters to continue providing food and fuel to the protest, claiming their repayment from the supporting lawfirms. The usage of lawfirms prevented bank seizures, afraid that seizing unrelated Canadian fiat accounts would trigger a prolonged legal battle.

When police raided the protest under a declaration of martial law, they were unable to seize the underlying crypto assets. As the declaration of martial law imploded within a few days, this temporary reprieve was enough – the declaration of martial law was retracted, lawsuits were filed, and ultimately the lawfirms were able to return ownership of the tokens to the protestors, before redeeming them for the underlying assets.

Transaction Design

The structure of these transactions uses an authority above, but with a single signer:

wallet_priv_key AND bank_key(wallet_pub_key)

It was this structure which required the government to negotiate with the issuing lawfirms over the underlying assets, rather than seizing them entirely: the independence of the issuing firm was a check on government overreach and authoritarianism.

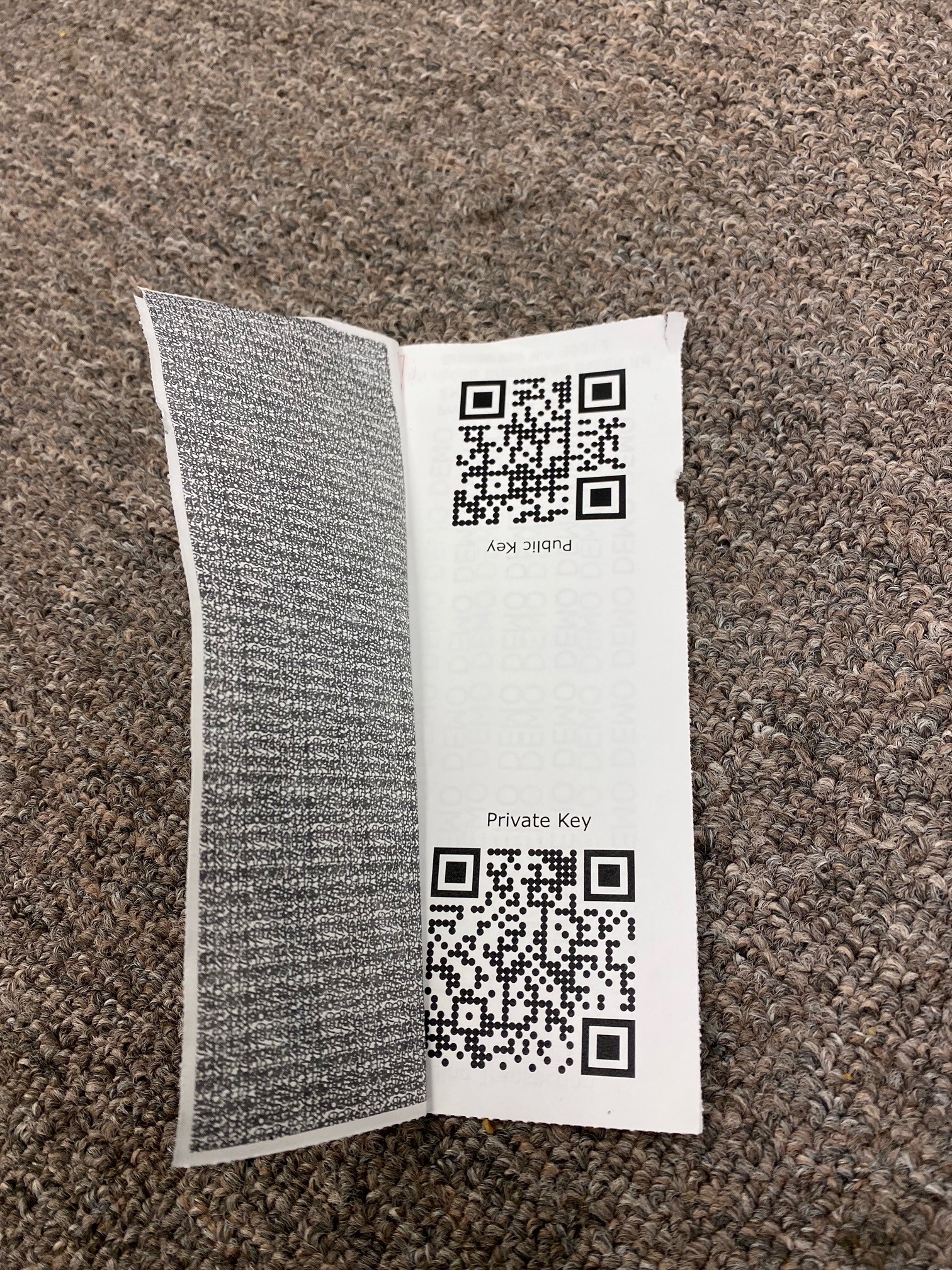

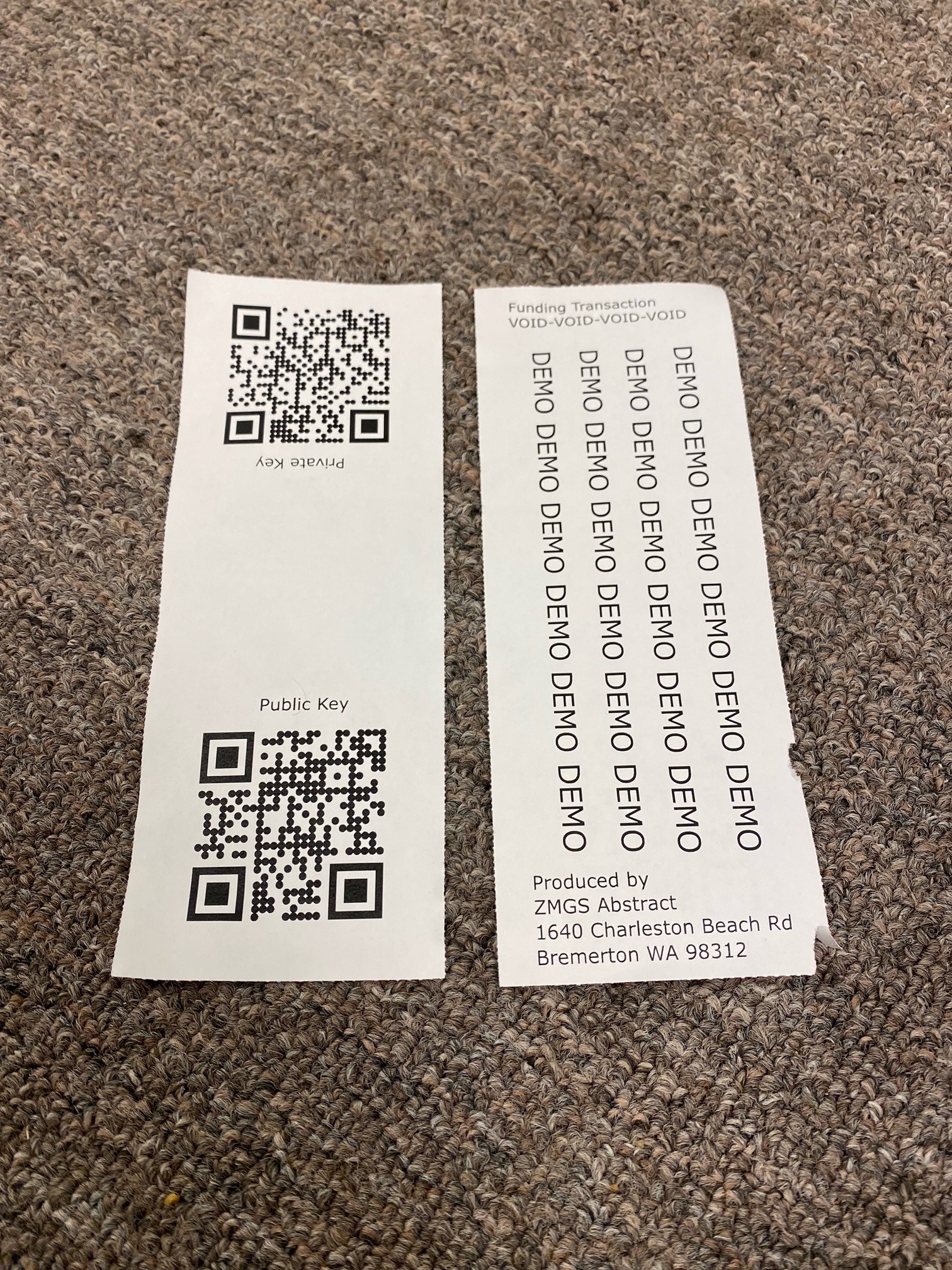

Paper Token

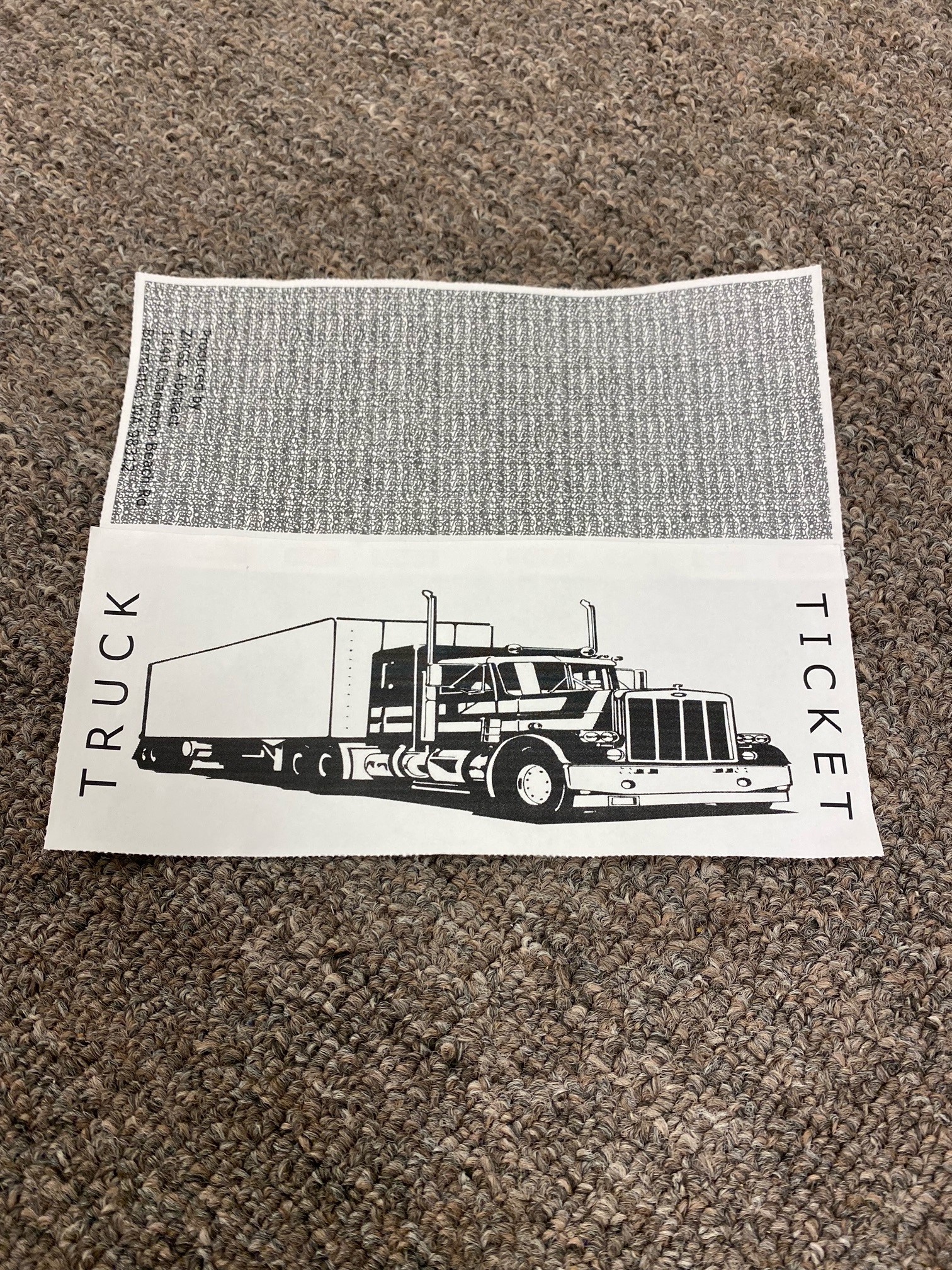

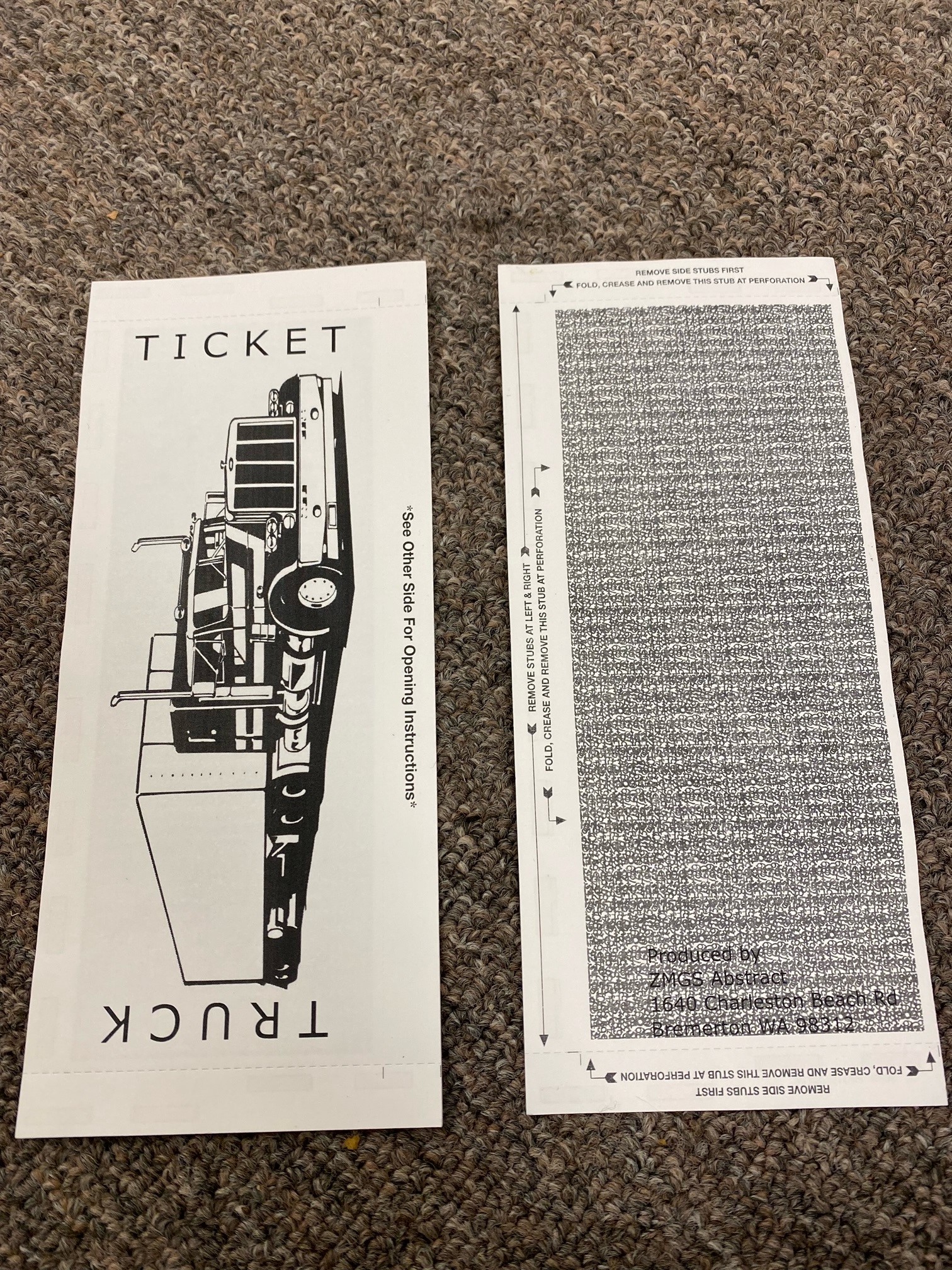

For illustrative purposes, we include a mock paper token that could be used for Truck Tickets:

Note – these are based on sealed mailers, a common office tool for law firms, insurance companies, etc. This was chosen because it allows for applications of this technique to be rapidly deployed on existing infrastructure.

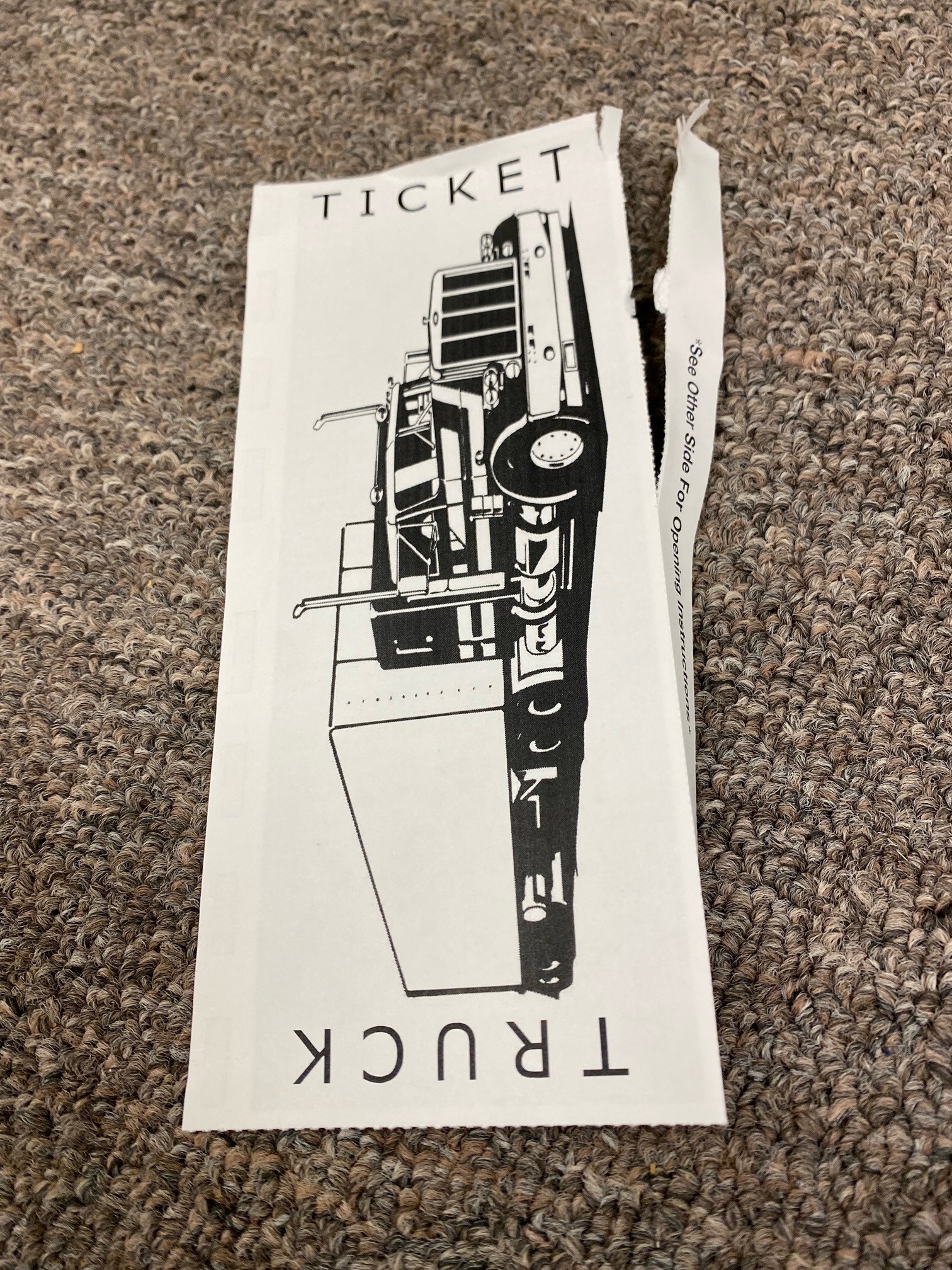

We also include a short slideshow of the printed version, for better illustration:

Folded and Sealed

Tearing Open to Access Key

Inner Layer Contains Keys

Inner Ticket Removed for Easy Claiming

Shell Can Be Kept As Memento